New challenges lead R&D companies to look beyond their specialties

January 17, 2024

By Ann-Marie Roche

© istock.com/erhui1979

Companies are spending more on R&D to gain competitive advantage — but what is the decisive factor for success?

Challenges continue to mount for R&D-intensive companies. In addition to making sure they can rely on information and research — an issue we recently discussed in our articles The cost of fraudulent research and Fighting the problem of fraud in publishing — they are facing the ever-growing pressure of constantly adapting to the business environment.

Evolving to meet the challenges of today

Historically, R&D-intensive companies have focused their efforts in specific areas. For instance, while one large pharmaceutical company may be known for its cancer therapeutics, another might focus the bulk of its research on antiretroviral drugs. Or one manufacturer may have spent decades building its reputation making a range of agricultural equipment, while another manufactures a popular line of diagnostic machines.

However, in recent years, the landscape has changed. Accelerating regulatory pressure has increased business costs. Competitive pressures have driven companies to seek new ways to generate revenue. Incredible technological advancements have presented organizations with an array of new digital tools — sometimes confusing and costly — to integrate into their processes.

Meanwhile, businesses are also deeply affected by a growing list of external factors ranging from the global COVID-19 pandemic and supply chain issues to urgent concerns about climate change and the environment.

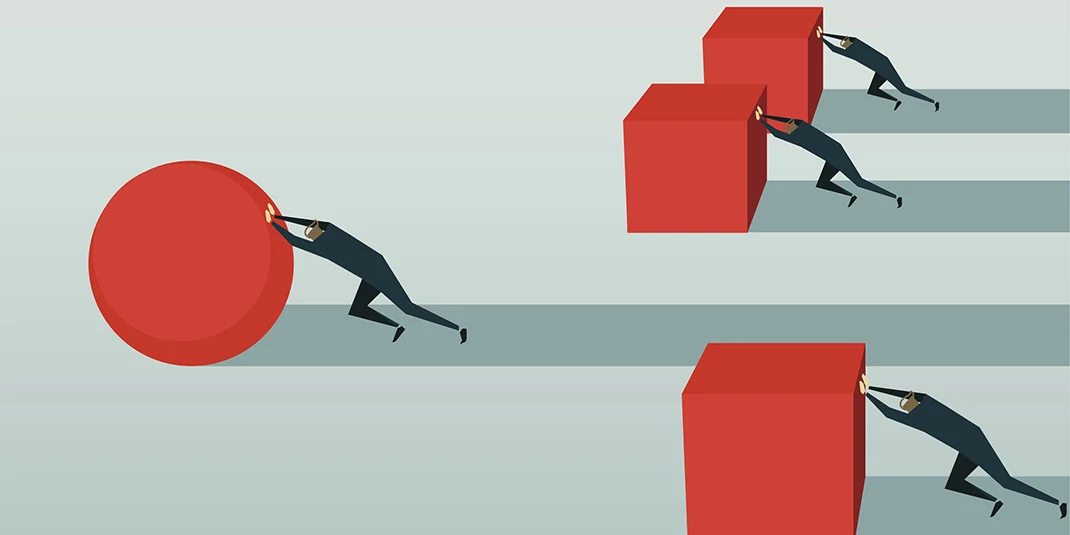

With so much change and upheaval, companies that wish to remain competitive and relevant cannot rest on their laurels or continue business as usual. Many organizations are venturing into new business areas to generate revenue, optimizing costs with vertical integration, and embracing strategic partnerships to share in investment costs.

Expanding and innovating

In some cases, a company that has a long history in one specialty may switch focus to something new. Take Pierre Fabre, which has specialized in dermo-cosmetics since the 1950s but is increasingly dedicated to fighting cancer, now spending 80% of its R&D budget on oncology. To support this concentration on cancer drugs, the company has recently established partnerships with Vernalis Research and Scorpion Therapeutics to aid in drug discovery and has acquired Vertical Bio, which develops novel cancer therapies.

Even a company like Bayer, which already has a diversity of specialties from aspirin to agribusiness, is continuing to broaden its areas of research and tackle unmet medical needs. In early 2023, Bayer revealed that it plans to spend $1 billion in drug research and development in the US in an effort to build up its new drug portfolio and double sales by 2030. Currently, the company’s full and varied pipeline includes treatments for prostate cancer and heart disease, as well as early-stage gene and cell therapies designed to treat Parkinson’s, muscular dystrophy, Huntington’s Disease and more.

General Electric (GE) is another giant that continues to expand into new areas. Best known for broadcasting and home appliances in a previous era, GE went on to have a hand in everything from jet engines to medical equipment. Now, it is also focusing on renewable energy. Though this is not a lucrative business yet, a storied company that wants to continue thriving has to be able to look into the future and see where the growth will be — and wind power in particular shows a lot of promise for GE.

Renewables are indeed one of the chief areas businesses in virtually all sectors are increasing R&D investment. Changing regulations and net zero goals have led many companies to significantly increase their spend on clean energy alternatives. Reuters calculates that automakers, for instance, expect to invest approximately $1.2 trillion on electric vehicles (EVs), batteries and associated materials through 2030. Among traditional auto manufacturers, Volkswagen leads the pack with an aim to spend $55 billion in vehicle electrification and $57 billion in battery investment.

R&D spending trends upward

The data confirms that companies are seeing a need to innovate and expand. Businesses spent $602 billion on R&D in the US — a 12.1% increase from 2020, according to the 2021 Business Enterprise Research and Development (BERD) Survey. More than half of that ($326,060 billion) was spent in manufacturing industries ($100,220 of which specifically went to pharmaceuticals and medicine).

The increase in clean energy investment is also clear. In its World Energy Investment 2023 report, the IEA estimated that about $2.8 trillion will be invested in energy in 2023, with more than $1.7 trillion of that going to clean energy “including renewable power, nuclear, grids, storage, low-emission fuels, efficiency improvements and end-use renewables and electrification.”

Discover new ideas and dependable research

Making the choice to increase investment in innovation is the first step for forward-thinking companies. But it’s up to their R&D teams to make it happen: it’s crucial that they have access to reliable information: quality multidisciplinary research that allows them to keep pace with changes on different fronts.

Moving into new specialties requires gaining new kinds of expertise, whether it’s a pharmaceutical researcher looking to learn more about cutting-edge immunotherapies, or an engineer at a building firm trying to increase their understanding of solar power.

Whatever your specialty or sector, the ScienceDirect Corporate Edition can help you explore new topics and expand your knowledge of the latest technological advancements. With its broad coverage across different subject areas, your team will be able to adapt to your business’s ever-shifting priorities, whether the challenge is coming from competition, environmental concerns, regulation, geopolitical events, or all of these.

Contributor

AR

Ann-Marie Roche

Senior Director of Customer Engagement Marketing

Elsevier

Read more about Ann-Marie Roche